Tax Treatment of Home Leave. For expatriate employees a tax concession is granted by.

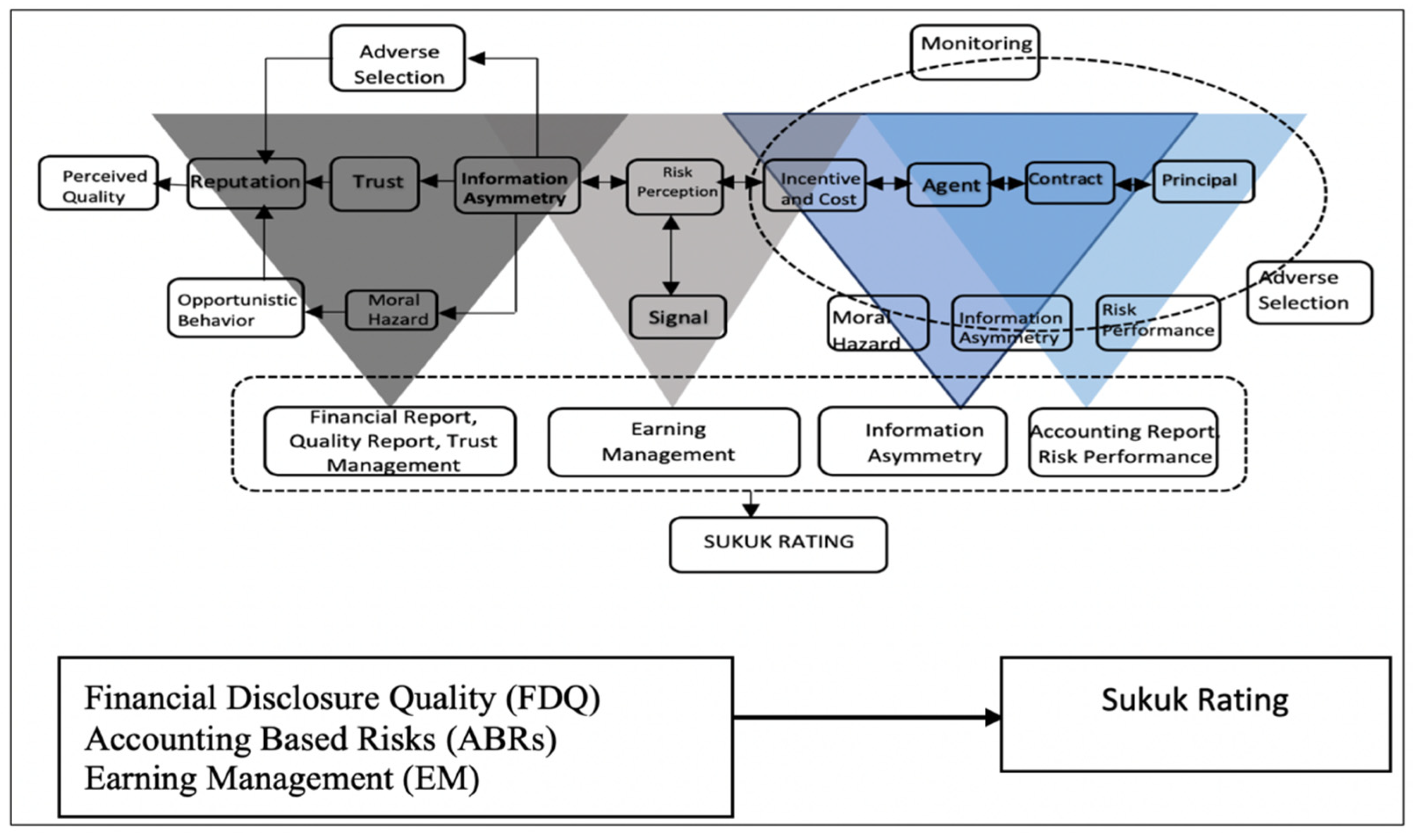

Risks Free Full Text The Determinant Of Sukuk Rating Agency Theory And Asymmetry Theory Perspectives Html

You are entitled to tax.

. PR 201711 Residence status of individuals. 12017 Date of Publication. Residents SPRs the full cost of the home leave passage provided to the employee and his family members is taxable.

Foreign Nationals Working In Malaysia - Tax Treatment. INLAND REVENUE BOARD OF MALAYSIA Translation from the original Bahasa Malaysia text DATE OF PUBLICATION. 8 June 2017 Page 1 of.

INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART I EXPENSES Public Ruling No. 12003 Date of Issue. Tax Treatment of Home Leave Passage From YA 2018.

The exemption of leave passage as below-a Leave passage in Malaysia less than 3 times in one calendar year or. The home leave passages provided to expatriates their spouses and children are taxable in full. Discuss the tax treatment for both overseas and local trip expenses incurred by HL Ace Sdn Bhd.

12 DECEMBER 2019. Mr M is not considered as a. The following leave passages are exempted from tax.

TAX TREATMENT OF LEAVE PASSAGE INLAND REVENUE BOARD MALAYSIA Public Ruling No. PR 20118 Foreign nationals working in Malaysia. PR 20121 Compensation for loss of employment.

Two for each child. Leave passage refers to vacation time paid for by your employer. The tax treatment in relation to benefit in kind.

B Overseas leave passage of not more than once in any. Posted on March 12 2021 by. Superceded by Public Ruling No122017 29122017 - Refer Year 2017.

Leave passage tax treatment in malaysia 2017 The following income categories are exempt from income tax. Puan Rina is exempted from tax on the overseas leave passage benefit of RM300000 in the year 2003 for the year of assessment 2003 but would be taxed on the remaining amount of. 5 August 2003 _____ Mauritius and the total leave passage cost claimed.

PR 201711 Residence status of individuals. Oversea leave passage tax treatment in malaysia. The following items are qualified for tax exemption.

Leave Passage Tax Treatment In Malaysia 2017 Gingerqwe

Risks Free Full Text The Determinant Of Sukuk Rating Agency Theory And Asymmetry Theory Perspectives Html

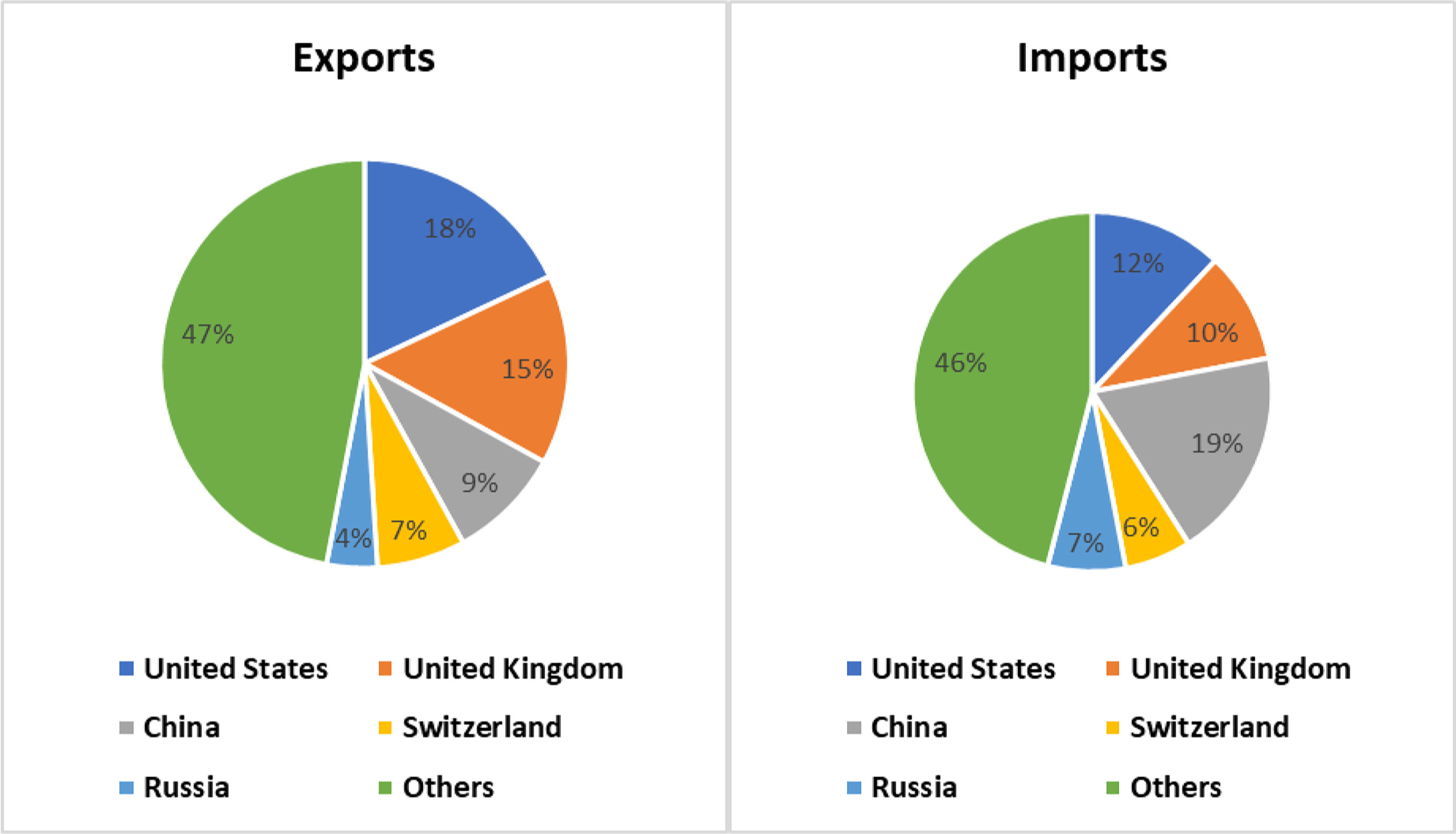

Frontiers Brexit And Its Impact On The Co Operation Along With The 21st Century Maritime Silk Road Assessment From Port Governance

Diagnosing America S Health Care Mess Part 2

Leave Passage Tax Treatment In Malaysia 2017 Gingerqwe

Pdf Assessment Of Equity In Property Taxation In Nairobi City

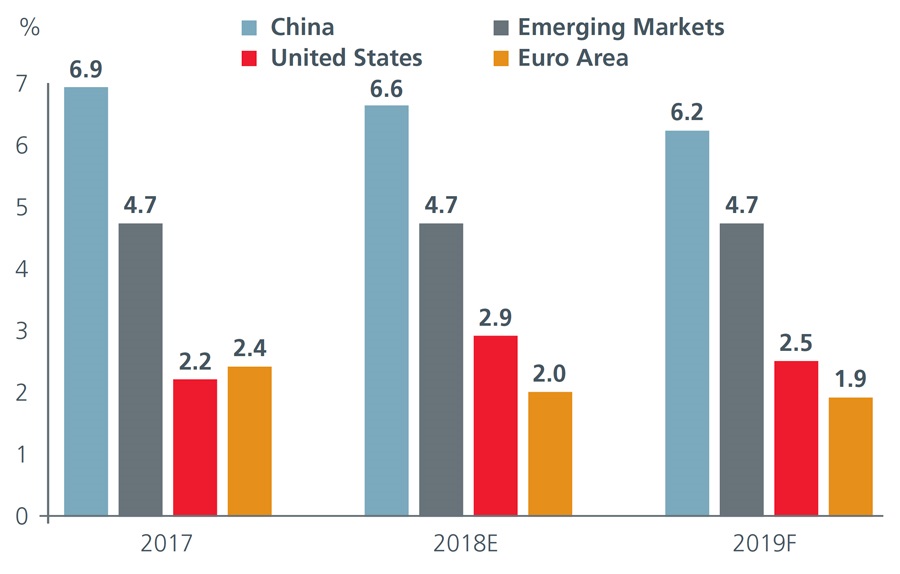

2019 Market Outlook A Rite Of Passage Into A Multipolar World Virginie Maisonneuve

Leave Passage Tax Treatment In Malaysia 2017 Gingerqwe